- November 8, 2024

- Posted by: admin

- Categories: Business, Financial Services

Suspicious Activity Reports (SARs) and Suspicious Transaction

Reports (STRs)

Suspicious Activity Report (SAR) and Suspicious Transaction Report (STR) are a mandatory notification that financial institutions use to alert authorities when they detect activities or transactions that appear suspicious. These activities or transactions might be linked to activities like money laundering or terrorism financing.

The significance of SARs / STRs lies in the fact that filing them is not optional. Financial Institutions are legally required to submit these reports as soon as they observe any suspicious behavior. These reports are essential in anti-money laundering (AML) / Terrorist Financing (TF) and help authorities track and investigate various activities that suggest attempts to hide illicit financial transactions.

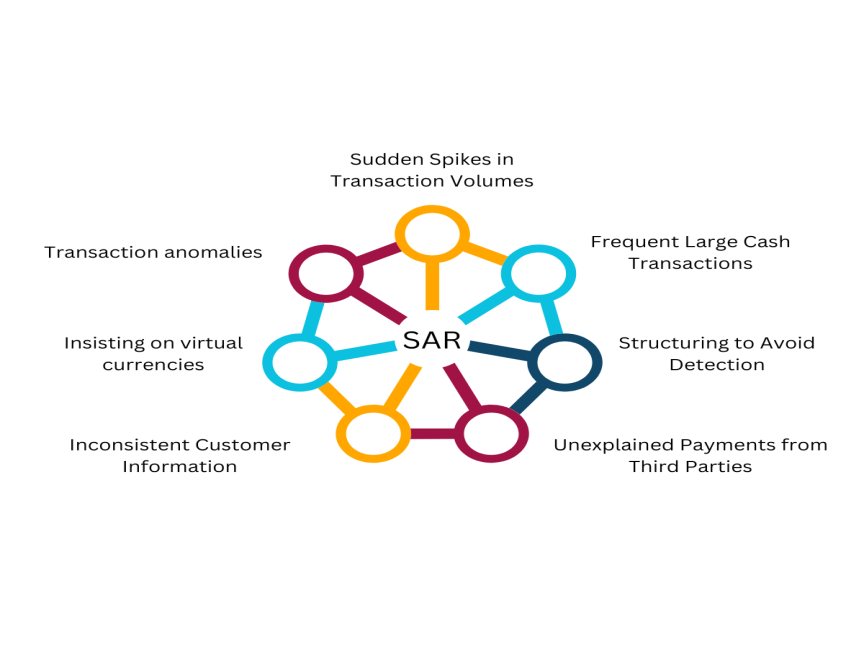

Common Signs of Suspicious Financial Activity:

Under the UAE AML Law, a SAR / STR must be filed when there are signs that a transaction or a customer’s behavior raises red flags about potential criminal activity or money laundering. Here are some common situations when an SAR / STR should be submitted:

Sudden Spikes in Transaction Volumes

A sharp increase in the number or size of transactions, especially when it does not match the customer’s usual behavior, can raise concerns.

Frequent Large Cash Transactions

Regular deposits or withdrawals of large amounts of cash, particularly if they see inconsistent with the customer’s normal business activities, are often suspicious.

Structuring to Avoid Detection

Sometimes, individuals will intentionally break large transactions into smaller amounts to avoid hitting reporting thresholds. This tactic is used to escape scrutiny and is called ‘smurfing’

Unexplained Payments from Third Parties

Receiving or sending payments involving unrelated third parties, with no clear link to the customer’s usual activities, is another warning sign.

Inconsistent Customer Information

Discrepancies in the information provided by the customer, such as mismatches in identification or business affiliations, can suggest suspicious behavior.

Inconsistent Customer Information: Various unusual patterns, such as a sudden rush of transactions,

last-minute changes in transaction details, or transaction values that don’t match the

customer’s income.

The Role of goAML Portal

goAML is an essential software application utilized by the UAE Financial Intelligence Unit (FIU). Its primary role is to gather information concerning suspicious transactions that have been identified by various reporting entities within the UAE. These entities include Financial Institutions and other organizations obligated to report such activities under UAE regulations.

All submissions must be conducted through the goAML Portal when reporting suspicious transactions to the UAE FIU. This portal serves as the designated platform through which these reports are securely submitted, ensuring compliance with UAE’s financial regulatory requirements focused on preventing money laundering and other financial crimes.

In the UAE, goAML registration is required for specific businesses that fall under anti-money laundering (AML) regulations. These include financial institutions, designated non-financial businesses and professions (DNFBPs), and virtual asset service providers (VASPs). These entities must register and report any suspicious transactions to the UAE Financial Intelligence Unit (FIU) through the goAML Portal.

Key Considerations for STR / SAR Submission Under UAE Law

In the UAE, the Federal Decree-Law No. (20) of 2018 on Anti-Money Laundering and Countering the Financing of Terrorism mandates that suspicious activities and transactions be reported immediately to authorities through goAML. Timely submission is critical, as any delays in reporting could result in penalties for the reporting institution.

It is important to note that SAR / STR processes differ by country. Each jurisdiction may have unique reporting thresholds, timelines, and formats for SAR / STR submission.

Consequences of Failing to Report Suspicious Activity

Failure to report suspicious activity through the goAML platform in the UAE can have serious consequences. Companies could face hefty fines, which can hurt their finances. Beyond the financial penalties, there is also the risk of damaging their reputation, leading to a loss of trust from clients and partners. In some cases, individuals involved could face legal action, including criminal charges. Plus, if a company repeatedly fails to comply, it could end up facing restrictions on its operations or even losing its business license, which would significantly disrupt its activities.

Conclusion:

It is clear that understanding these reports is essential for safeguarding our financial systems. As Financial institutions continue to evolve, staying informed about SAR / STR compliance is not just about meeting regulations, it is about strategically positioning oneself to fight against financial crimes effectively.

Note: At Limitless Consulting, we are here to guide you through these complexities, ensuring that

your organization not only meets compliance requirements but thrives in a secure financial

environment.